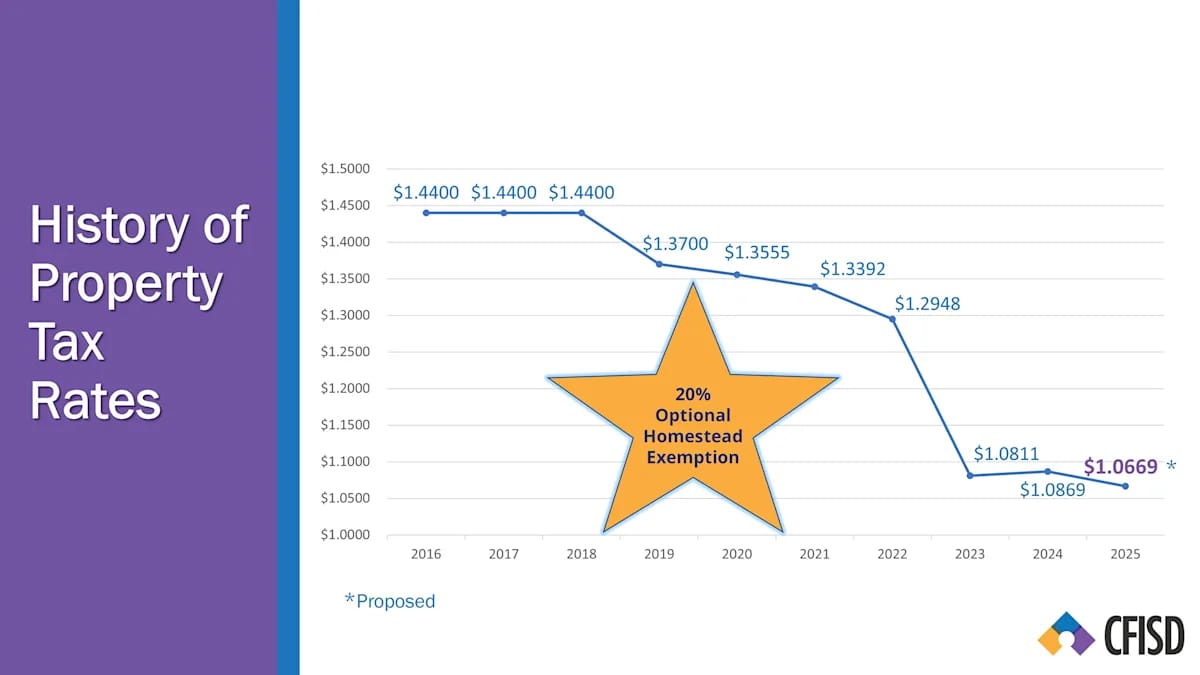

CYPRESS, Texas — October 28, 2025 — Cypress-Fairbanks ISD homeowners will see lower property tax bills this year after the CFISD Board of Trustees voted to approve a 2025 tax rate of $1.0669 per $100 of property valuation—a 2-cent reduction from 2024 and the district’s lowest rate in nearly four decades

The total rate is made up of $0.6669 for Maintenance & Operations (M&O)—which funds day-to-day operations—and $0.40 for Interest & Sinking (I&S), which covers debt repayment.

You can download the release below:

What the Change Means for Homeowners

For a home valued at $350,000, the 20% local homestead exemption and the $100,000 state exemption together reduce the taxable amount to about $180,000.

Under the new 2025 rate, homeowners would pay approximately $1,920 to CFISD—down from $1,956 in 2024.

That’s a $36 savings from the school district portion alone, not counting potential reductions from other jurisdictions like Harris County or local MUDs.

If voters approve two constitutional amendments on the November ballot, homeowners could see even greater relief:

Proposition 13 (SJR 2) would raise the state homestead exemption from $100,000 to $140,000.

Proposition 11 (SJR 85) would increase the over-65 or disabled exemption from $10,000 to $60,000

CFISD’s Long-Term Tax Efforts

The district’s new tax rate is more than 37 cents lower than it was 10 years ago, marking a continued effort to ease the financial burden on local residents while maintaining strong public school operations and infrastructure

Combined with exemptions and potential new state-level measures, Cypress-area homeowners could see their lowest effective tax bills in decades—a welcome change amid rising property values across Harris County.

Learn More

To view your itemized property tax breakdown, visit the Harris County Appraisal District (HCAD) website at www.hcad.org.

There, homeowners can:

Review all jurisdictions and tax rates affecting their property,

See how homestead exemptions are applied, and

Estimate their total 2025 property tax bill across CFISD, Harris County, MUDs, and other entities.

📊 Item | 2024 | 2025 |

|---|---|---|

CFISD Tax Rate | $1.0869 | $1.0669 |

Avg. Home Value (CFISD) | $350,000 | $350,000 |

Local Homestead Exemption | 20% | 20% |

State Homestead Exemption | $100,000 | $100,000 (proposed $140,000 pending vote) |

Avg. CFISD Tax (after exemptions) | $1,956 | $1,920 |

Avg. Annual Savings | — | $36 |

💡 If Propositions 13 and 11 pass, the average homeowner could save an additional $300–$400 per year.